Investing in LMNP in France (Non-Professional Furnished Rental) is a popular strategy for building wealth, generating tax-optimized rental income, and benefiting from a flexible and advantageous regime. However, choosing the right location is crucial to maximize profitability.

Certain cities stand out due to their rental market dynamism, economic attractiveness, or favorable local taxation. Here are the key criteria to consider and the top cities to invest in LMNP in 2025.

The LMNP status allows for property and expense depreciation (under the real regime) or benefits from a flat-rate deduction (micro-BIC). However, overall profitability primarily depends on the chosen city: rental demand, market tension, local taxation, price trends, etc.

A successful LMNP investment should combine:

Strong rental demand (students, young professionals, tourists)

High market tension (cities where demand exceeds supply)

Purchase price aligned with potential rent

Stable and controlled taxation

Is the price per square meter compatible with the prevailing rents?

Is the property located in a zone eligible for Pinel/Denormandie zoning (as a backup plan)?

Is the target audience active? Students? Mobile professionals? Seniors?

Is the area well-served by public transport?

Is rental vacancy low?

Is it easy to practice long-term or seasonal furnished rentals there?

Strong student and professional rental demand

Dynamic metropolis with excellent transport links

Highly sought-after neighborhoods: Part-Dieu, Guillotière, Villeurbanne

Net profitability around 4% to 5%

High quality of life, employment hub, and demographic growth

Excellent price-to-profitability ratio

Notable neighborhoods: Dervallières, Zola, Île de Nantes

Major university center with proximity to Paris and Brussels

Stable rents and low rental vacancy

Ideal for furnished shared accommodations

Caution advised due to high prices in the city center

Good potential in redeveloping neighborhoods: Bastide, Bègles

Prefer the real LMNP regime to mitigate tax impact

France’s 4th largest city with strong growth and an aerospace ecosystem

Excellent investment-to-profitability ratio

Key neighborhoods: Rangueil, Saint-Cyprien, Côte Pavée

Very high rental demand but elevated acquisition prices

Low yield but significant capital appreciation potential

Focus on student studios or renovated maid’s rooms

Angers, Clermont-Ferrand, Reims, Dijon: less saturated markets but higher yields

Worth considering for properties under €150,000, suitable for LMNP

| Type of City | Recommended Property | Ideal Target |

|---|---|---|

| Student City | Studio or One-Bedroom | Students, Young Professionals |

| Tourist City | Furnished Two or Three-Bedroom Apartment | Tourists, Digital Nomads |

| Tertiary City | Two or Three-Bedroom Near Train Station or Tram | Executives, Employees on Temporary Assignments |

Two possible options:

Traditional furnished rental: more flexibility, higher gross return, but requires self-management or working with a rental agency.

Serviced residence (student, senior, business): ideal if you’re looking for a turnkey investment with guaranteed rental income. Attractive tax benefits, especially if you reclaim VAT on the purchase (under LMNP Censi-Bouvard status or real depreciation regime).

If you invest in a city with moderate rental yields (like Paris or Bordeaux), the real tax regime is more suitable, allowing you to depreciate the value of your property and potentially eliminate rental income from taxation.

In cities with high gross yields (>6%), the micro-BIC regime can be sufficient if your expenses are low (with a 50% flat-rate deduction).

👉 Use our LMNP Micro-BIC or Real Regime Simulator to choose the right option.

| LMNP Regime | For Whom? | Main Tax Advantage |

|---|---|---|

| Micro-BIC | Rental income < €77,700/year | 50% flat-rate deduction |

| Real regime | High expenses or bank loan | Deduction of actual expenses + depreciation |

💡 On average, 70% of LMNP investors under the real regime pay no tax on rental income during the first few years.

Choosing where to invest in LMNP isn’t just about looking at a map or following trends. It means aligning your goals (return, taxes, wealth building) with the local real estate dynamics.

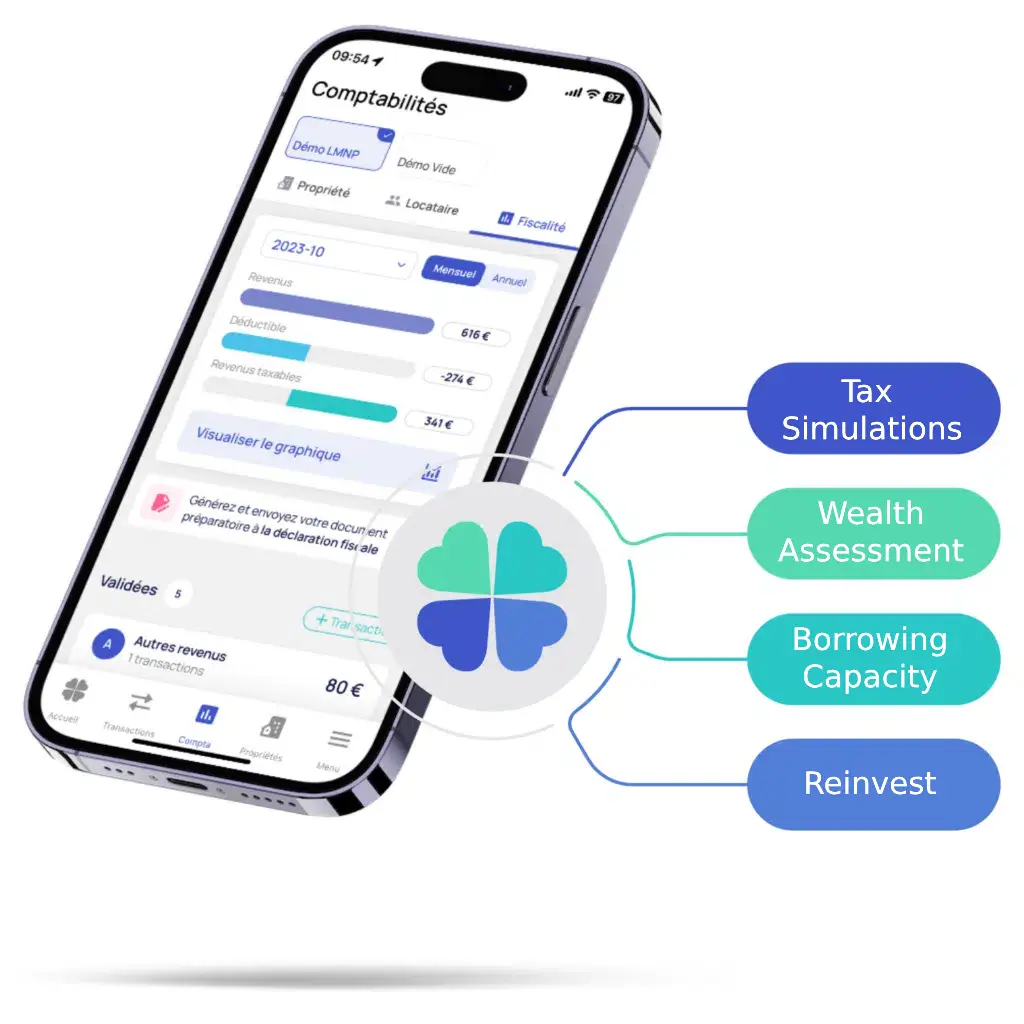

👉 Need help choosing the right city, property, or LMNP tax regime?

Qlower experts support you with your furnished rental investment strategy — from simulations to tax declarations.

Yes, provided there is strong rental demand (students, employment hubs, tourist appeal).

Lille, Lyon, Toulouse, Montpellier, and Rennes have large student populations and strong demand for furnished studios or one-bedroom apartments.

Both are possible. New properties often allow for delegated management in serviced residences, while older properties offer more flexibility and often a lower price per square meter.

No. LMNP applies to furnished rentals, whereas Pinel and Denormandie are for unfurnished (bare) rentals.

Platforms like Qlower’s LMNP simulator help you estimate rental yields, purchase prices, and the most suitable tax regime.

Qlower offers an accounting package starting at €269 excl. tax per year, including depreciation, tax declarations, and an online dashboard to track your performance.

To make the right decisions, it is highly recommended to seek guidance from a real estate tax expert. Say goodbye to the headache of complex taxation, and hello to optimizing your personal and financial situation.

Qlower is here to guide you in the best possible way based on your specific circumstances! Don’t hesitate to book an appointment with one of our experts!

Join the Qlower Community

Qlower offers useful content (articles, tips, and more) to help you build and grow your real estate portfolio. Join the Qlower community and share your questions and feedback.

Obtenez dès maintenant tous les conseils d’experts pour vous faciliter la vie et boostez votre activité de loueur en meublé