Renting out a property on Airbnb or similar platforms in France requires compliance with specific legal obligations, including obtaining a SIRET number. Discover why this number is mandatory and the steps to acquire it promptly.

Any furnished rental activity in France, including short-term rentals on platforms like Airbnb and Booking, must be declared. Obtaining a SIRET number is mandatory from the start of the rental activity, whether you’re under the Micro-BIC or Real Regime.

Primary Residence: If you occasionally rent out your primary residence on Airbnb, a SIRET number isn’t required unless your income exceeds a certain threshold.

Seasonal Rental: For regular rentals or secondary properties, registration with a SIRET number is mandatory.

Since 2023, all business creation formalities must be completed through the INPI’s Single Window. Here’s how:

Micro-BIC: This simplified regime applies if your annual income doesn’t exceed €77,700 (in 2025). You benefit from a flat-rate deduction of 50%. Note: different thresholds apply if you’re renting short-term and whether your property is classified or not, potentially lowering to €15,000 with a 30% deduction.

Real Regime: This regime is mandatory beyond the €77,700 threshold (€15,000 for unclassified short-term rentals) or if you voluntarily choose this option. It allows you to deduct all your expenses, including property depreciation.

Deadline: The application must be submitted within 15 days of starting the rental activity.

Required Documents: Proof of identity, proof of address, property deed or rental contract, and possibly a social security number if you’re a French resident.

Each rented property must be associated with a distinct SIRET number. The SIREN number (first 9 digits of the SIRET) will be the same if the ownership structure (same owner(s)) is identical.

However, if multiple properties are grouped under the same address, a single SIRET number might suffice.

If you add a new property to your Airbnb activity, simply modify your initial declaration on the INPI’s Single Window by adding an establishment to the existing SIREN.

Renting without a SIRET number can lead to fiscal and administrative fines.

The absence of a SIRET number also makes it impossible to legally declare your Airbnb income under the Real Regime, exposing you to tax reassessment.

By default, you’re prohibited from deducting all your rental expenses and the annual depreciation of your property, which often represent more than 50% of your income.

You’re penalized by not being able to deduct acquisition costs from your taxable income (notary fees, agency fees, brokerage, etc.), which can often represent 10 to 15% of your property’s purchase price.

Submit a retroactive declaration on the INPI’s Single Window.

Contact our experts for personalized support and to avoid any errors during the procedure.

Yes, but only if you rent your primary residence occasionally and your annual income doesn’t exceed the legal threshold [€760]. For any other rental, a SIRET number is mandatory.

Under the Micro-BIC regime: Enter your gross income in the corresponding box of your income tax return (form 2042).

Under the Real Regime: Use form 2031-SD and its annexes to detail your income and expenses and prepare your tax package (balance sheet, income statement). The taxable income should be reported on your income tax return (form 2042 C-PRO)

Yes, if you stop renting one property and start renting another. If the new property is added to your existing activity, simply declare this additional property on the Single Window.

Expatriates must provide proof of identity, a correspondence address in France, and indicate their social security number if they are of French nationality.

You can still regularize your situation by submitting a retroactive declaration via the INPI’s Guichet Unique platform. However, your tax regime may be challenged, and penalties can apply in the event of a tax audit.

Log in to your personal space on the INPI’s Guichet Unique platform, select the modification of your activity, and enter the information about the new property.

Failure to have a SIRET number during a tax audit can result in fines and a tax reassessment for undeclared income or the loss of eligibility for the real tax regime.

Yes, the SIRET number obtained for a furnished rental activity is valid for all rental platforms, including Airbnb, Booking, and Abritel.

Need help getting your SIRET number and launching your Airbnb activity legally?

Contact our experts for personalized support.

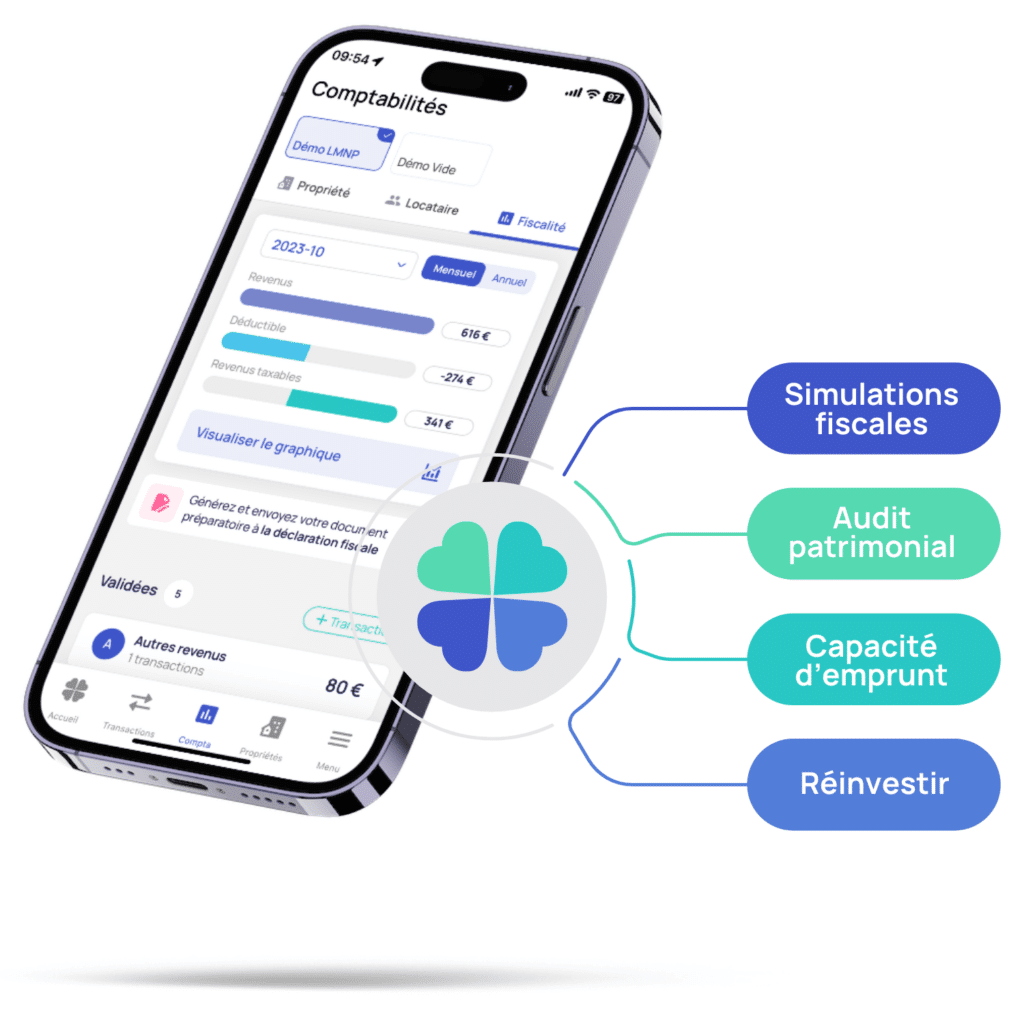

To make the right decisions, it is strongly recommended to seek guidance from a real estate tax expert — no more tax headaches, only optimized management of your personal and property situation.

Qlower is here to guide you based on your specific situation!

Don’t hesitate to book an appointment with one of our experts!

Join the Qlower Community

Qlower offers useful content (articles, tips, and more) to help you build and grow your real estate portfolio. Join the Qlower community and share your questions and feedback.

Obtenez dès maintenant tous les conseils d’experts pour vous faciliter la vie et boostez votre activité de loueur en meublé