Article mis à jour le 17/10/24

The 2025 Finance Bill (PLF 2025) introduces a major tax reform for Non-Professional Furnished Rental Operators (LMNP), challenging one of the key fiscal advantages of this status: depreciation.

Starting in 2025, depreciation deductions will be reintegrated into the capital gains calculation upon the resale of a property, impacting investor taxation.

This article will break down the details of this reform, its effects on rental property profitability, and the strategies investors can adopt to adjust to this new fiscal framework.

⚠️ Note: At this stage, this measure is only a proposal in the 2025 Finance Bill (PLF 2025).

The 2025 Finance Bill (PLF 2025) introduces significant tax reforms aimed at adjusting the Non-Professional Furnished Rental (LMNP) scheme. This proposal is part of a broader tax rebalancing initiative, particularly in response to the housing market pressures in high-demand and tourist areas.

One of the main measures concerns the reincorporation of depreciation into the capital gains calculation upon the sale of an LMNP property. This modifies a key tax advantage that investors have relied upon for years.

The PLF 2025 is an annual legislative proposal that sets the budgetary and tax policies of the French government for the coming year.

For LMNP property owners, this bill proposes significant changes, including:

The LMNP status is a popular tax scheme among investors due to its depreciation benefits, which allow for a significant reduction in taxable rental income.

However, the PLF 2025 seeks to modify what is considered an overly favorable tax structure. The government’s goal is to align LMNP capital gains taxation with other real estate investment models by:

This reform is a response to housing shortages and the lack of available long-term rental properties in certain high-demand areas.

The reintegration of depreciation into the calculation of capital gains is one of the most significant changes proposed by the PLF 2025 for non-professional furnished rental (LMNP).

Currently, depreciation allows investors to reduce the taxation of rental income without affecting the taxation upon resale. With the reform, these depreciations will now reduce the purchase value, thereby increasing the taxable capital gain upon sale. This modification aims to align LMNP taxation with that of other real estate investment regimes.

According to the Court of Auditors’ report, two additional proposals, in addition to this key measure on depreciation, stand out to thoroughly reform the LMNP regime:

A real game-changer for LMNP property owners!

Currently, Non-Professional Furnished Rental Operators (LMNP) benefit from a highly advantageous tax system.

The PLF 2025 proposes to change this tax advantage by reintroducing depreciation deductions into capital gains calculations.

This reform aims to correct what lawmakers see as an excessive tax benefit for LMNP investors.

The reintroduction of depreciation into capital gains calculations will lead to:

The capital gains tax rate of 19% and social security contributions of 17.2% will apply to this revised taxable amount.

Learn more about LMNP depreciation and tax strategies in our exclusive 2025 guide.

The proposed PLF 2025 reform will not have the same impact on all LMNP investors. Short-term owners who resell their property after a few years will be the most affected.

On the other hand, those who hold their property for a long period will benefit from progressive capital gains tax exemptions.

These tax reductions (22 years for income tax exemption and 30 years for social security contributions exemption) help mitigate the impact of depreciation reintegration over time.

Certain situations allow LMNP investors to avoid capital gains taxation, even after depreciation reintegration. Gifts and inheritances are cases where capital gains taxation does not apply, as the property is transferred without being sold.

Moreover, many investors keep their property long-term, often until retirement or to pass it on to their heirs. These investors benefit from progressive tax exemptions, significantly reducing or even eliminating the tax impact of this reform.

With the tax changes introduced by PLF 2025, LMNP investors will need to adjust their strategy to minimize the impact of depreciation reintegration in capital gains calculations. Several approaches can be considered depending on investment goals.

For those planning to keep their property for the long term, the key strategy lies in the progressive tax reductions on capital gains. The longer the property is held, the less significant the effect of depreciation reintegration.

By holding onto the property, investors can reduce or even eliminate the impact of the reform upon resale.

Additionally, it is possible to convert the property into a primary residence.

According to Amendment No. I-CF275, submitted by the National Assembly on October 11, the following conditions apply:

“This amendment proposes to condition the exemption on a minimum period of at least five years as a primary residence. Naturally, this condition would not apply in cases where the sale is made to purchase another primary residence, which would otherwise penalize any transaction outside first-time homeownership. Similarly, this period could be waived in cases of urgent necessity, such as job relocation, long-term hospitalization, entry into a nursing home, or even death or separation.

This amendment targets loopholes in the current regulations.”

For high-income investors, transitioning to Professional Furnished Rental (LMP) status may be beneficial. This regime offers:

LMP status provides better control over rental investment taxation in the long run.

Another strategy involves diversifying investments. Instead of concentrating assets in one or two LMNP properties, investors can spread investments across different types of real estate assets, such as:

This diversification approach helps dilute tax risks and optimize overall profitability by taking advantage of various fiscal regimes and reducing exposure to legislative changes.

A real estate investment company (SCI) taxed under IS can reduce its annual taxable base and, consequently, its tax burden, by using depreciation on real estate and renovation work.

This structure can be a viable alternative for investors concerned about depreciation reintegration.

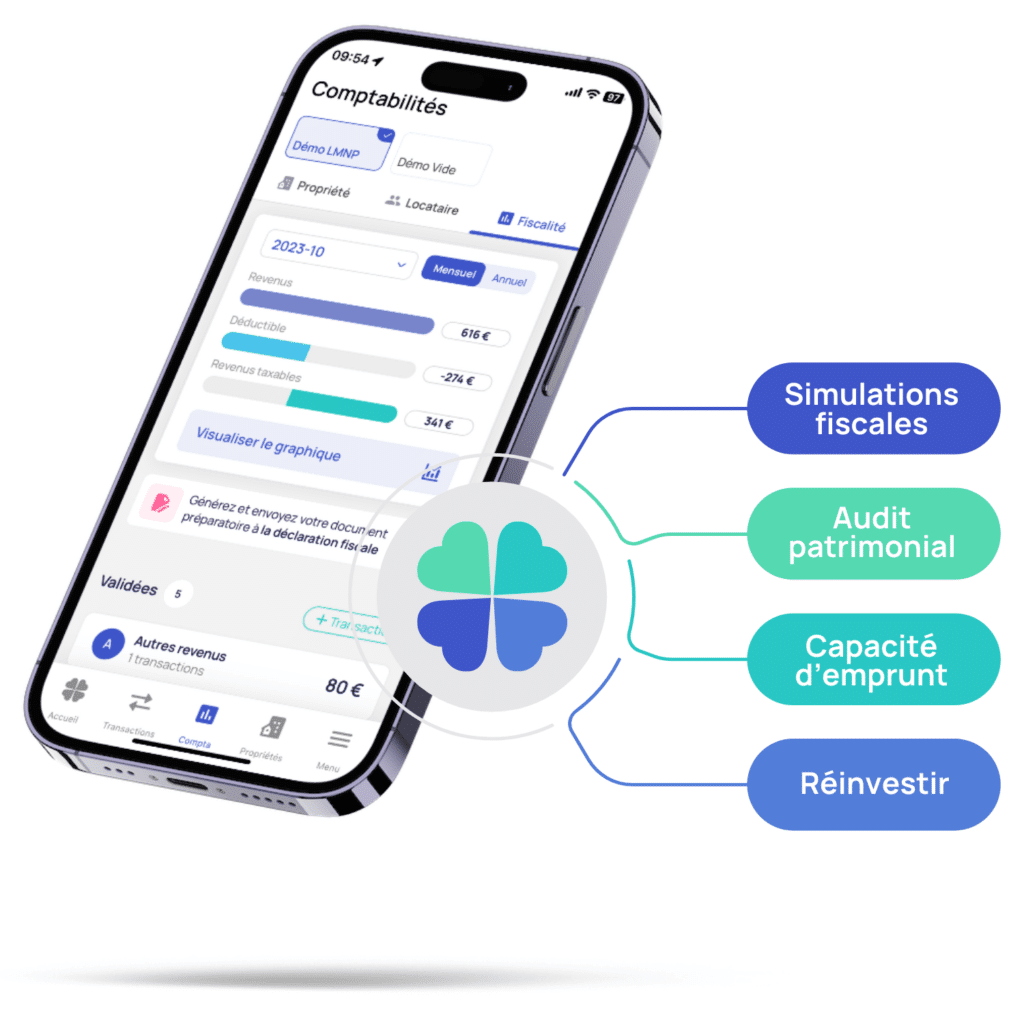

Working with Qlower advisors will be a valuable asset for LMNP investors, especially with the upcoming tax changes. Our experts can:

Additionally, Qlower provides personalized support and free tax simulations to help investors prepare for future fiscal reforms.

The tax reform proposed in PLF 2025 has sparked considerable debate among lawmakers and real estate professionals.

Since the PLF 2025 proposal, ongoing discussions in Parliament could lead to modifications before the final adoption of the bill.

Some policymakers advocate for:

If adopted as proposed, this reform could:

However, long-term LMNP investors will experience less impact, as depreciation reintegration will be progressively offset by tax exemptions.

The long-term effects of this reform will need to be closely monitored to understand its influence on rental supply and property prices in France.

The 2025 Finance Bill (PLF 2025) marks a significant turning point for LMNP investors, particularly with the reintegration of depreciation into capital gains taxation.

Although these changes may increase tax burdens, investors must:

By staying proactive, investors can continue optimizing their real estate portfolio and navigate an evolving fiscal landscape.

The PLF 2025 proposes to reintegrate depreciation into the calculation of capital gains when reselling an LMNP property, thereby increasing taxation.

Short-term investors will be the most impacted, as they will face the direct consequences of depreciation reintegration into capital gains. Those who hold their property long-term will benefit from progressive tax reductions.

By keeping your property long-term as a primary residence, considering the LMP (Professional Furnished Rental) status, switching to an SCI taxed under corporate tax (IS), or diversifying your real estate investments.

Yes, all LMNP investors are affected, but the impact will be less significant for those holding their properties long-term or transferring them through donation or inheritance.

Investors can consider switching to the LMP status or investing in other types of real estate to optimize their tax strategy.

Join the Qlower Community

Qlower offers useful content (articles, tips, and more) to help you build and grow your real estate portfolio. Join the Qlower community and share your questions and feedback.

Obtenez dès maintenant tous les conseils d’experts pour vous faciliter la vie et boostez votre activité de loueur en meublé